Editor's Note: The Role Of Battery Recycling In The Circular Economy is a three-part series. Part 1 focuses on Key Technologies. Part 2 focuses on the Battery Supply Chain, Logistics and Profitability. Part 3 focuses on Challenges and the Role of Policy.

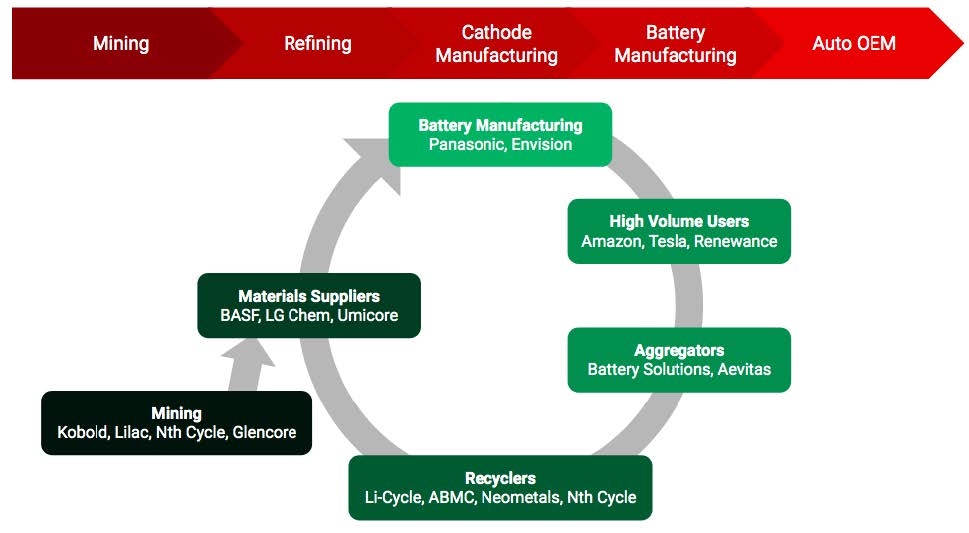

The current battery supply chain is shown in red in Figure 2. Low grade (e.g. 50%) material from mines is refined by a smelter to 97-99%, and further upgraded to battery specifications (99.9% or greater), before being sent to cathode manufacturers. As of 2019, upstream/mining (23%), midstream chemical refining (80%), cathode/anode production (66%), and downstream lithium ion battery cell production (73%) are all primarily located in China [10], with Europe slowly becoming the second largest Li-ion battery producer. In Europe, more than 1,000 GWh of cell manufacturing capacities have been announced as of March 2021. Elements such as nickel and cobalt are increasingly mined in the Democratic Republic of the Congo (DRC) by Chinese-owned companies, with forced child labor issues at many mines [11]. By 2030, cathodes made of NMC-811 and LFP will likely dominate production to increase nickel content in order to achieve high energy density and lower reliance on cobalt. Nonetheless, there is an anticipated 50% deficit for elements like cobalt in the next 5-10 years as low cobalt and cobalt-free cathodes are still under development.

The companies discussed in this article are shifting away from the traditional supply chain and working towards a more circular, diversified supply chain to decrease waste output, gain more price control, and avoid geopolitical negotiations. By collecting multiple materials that are inputs to batteries, recycling facilities can be set up like “the perfect mines,” with better unit economics and co-location of all the critical materials (see Figure 2 in green).

Figure 2. Incumbent battery production chain compared to the circular loop explored by companies in this article.

Note battery manufacturing, high-volume users, and aggregators

Recycling Logistics and Profitability

While all focused on the same challenge, the companies interviewed have adopted multiple different approaches to their business models and value proposition. Key considerations for profitability and scope include: rate and volume of take-back and adoption, transportation costs (shipping, handling, storage), safety requirements (shredding, separation, purification, need for inert conditions), value of waste output (disposal tipping fee) and recycled inputs (grade, purity), and location of buyers and sellers. For some companies (Nth Cycle), modularity allows for flexibility in location, low initial take-back volume, and customization to each customer’s feedstock. For others (American Battery Metals Corporation, Redwood Materials), centralization near battery producers or car manufacturers allows for large volume processing, ease of coordination, and onsite recycling.

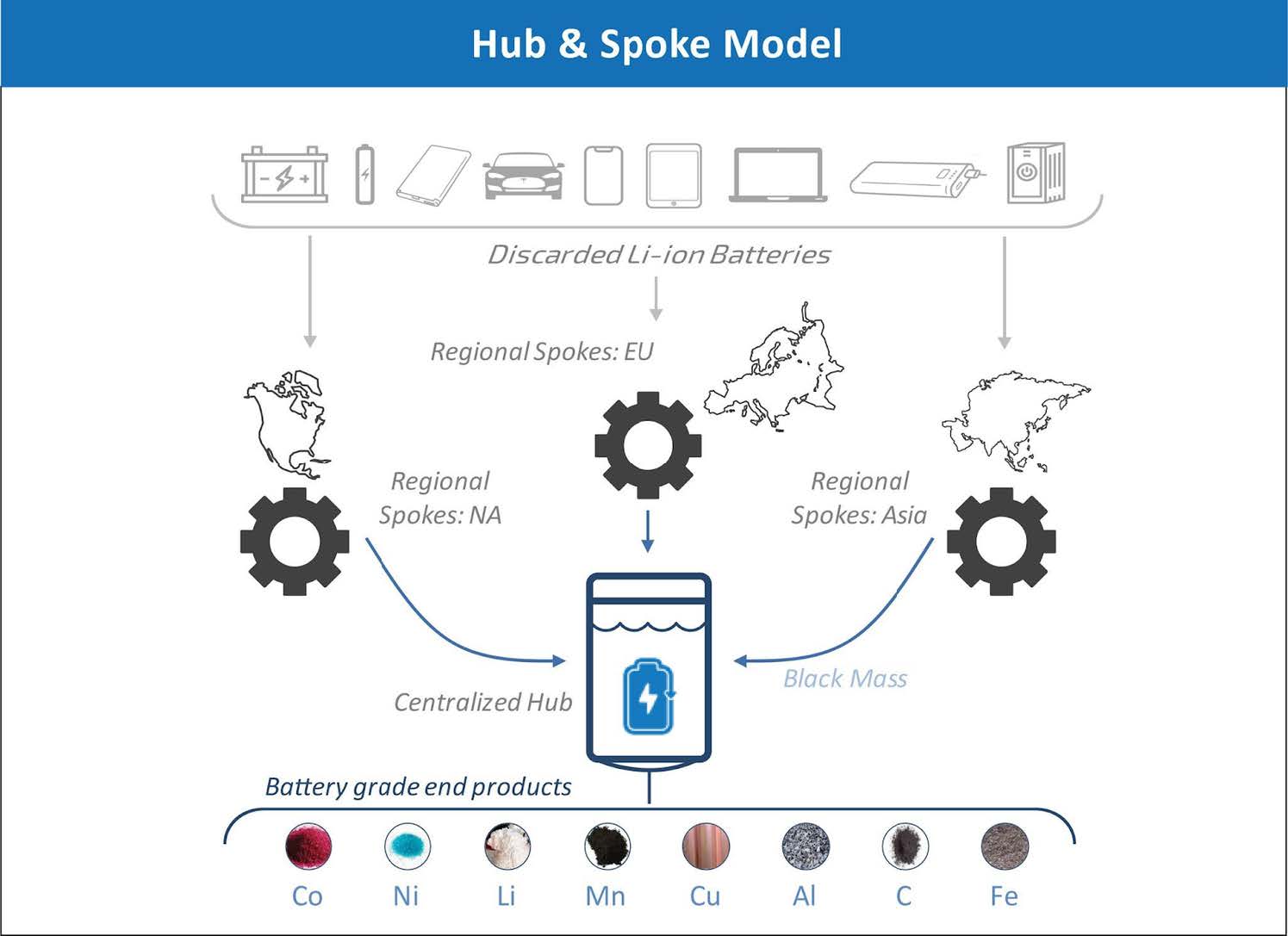

Li-Cycle relies on a spoke and hub model, distributing the pre-processing into different collection points and centralizing the post-processing (see Figure 3). The spoke portion feeds in batteries and outputs black mass, and the hub portion feeds in black mass and outputs battery-grade materials. Compared to Li-ion batteries, black mass is easier to transport and safer due to fewer hazardous waste concerns. Li-Cycle has developed extensive IP around their spoke development to avoid dismantling, sorting, and discharging batteries. Instead, they shred under a neutralizing solution to absorb the energy generated in a safe manner. The current spokes located in Kingston, ON and Rochester, NY have 5,000 tons/yr capacity for an estimate of recycling demand of ~100,000-500,000/yr now (largely from manufacturing scrap), approaching 1-5 million tons in 2030. Note that based on Li-Cycle estimates, manufacturing scrap currently represents 29% of the battery waste stream, but is expected to increase to 68% by 2025, with auto OEMs also representing a high percentage (16 to 25%).

Figure 3. Spoke and Hub model for discarded Li-ion batteries.

Li-Cycle will soon have a network of three spokes to feed the $175 million commercial hub at the Eastman Business Park (formerly housing Eastman Kodak, Xerox and Bausch & Lomb) in Rochester, with the plan to eventually hit economies of scale at one hub per continent. The locations of where spokes and hubs are built are related to where batteries are, EV penetration, and proximity to battery manufacturing to collect scrap. At their hubs, Li-Cycle utilizes hydrometallurgy to produce battery-grade lithium, nickel, and cobalt at >95% recovery rate. Li-Cycle has 12 formalized trade secrets in converting black mass into battery grade materials, with cobalt, nickel, and lithium all undergoing crystallization processes. In addition to the battery materials, significant revenue can also be obtained by building a fully circular loop of all key components. For example, Li-Cycle is also able to collect plastics for reuse or fuel production as well as copper and aluminum foils. These materials provide additional revenue streams which help the companies buffer themselves against changes in commodity pricing that impact the core cathode/battery materials.

American Battery Metals Corporation (ABMC) is currently exploring both mechanical-hydrometallurgical-based battery recycling and primary extraction of battery metals from virgin resources. This relies on the assumption that low-impact extraction methods for battery metals from virgin primary resources, in addition to recycling, will be necessary to meet demand at scale. ABMC is currently constructing a plant in Nevada with the ability to recycle 20,000 tons of batteries annually. Redwood Materials also operates in Nevada, close to Tesla’s Gigafactory and the expected high volume of end-of-life EVs from California.